On May 12, 2025, President Trump signed an executive order to cut drug prices in the U.S., a bold move that aims to reduce the cost of general medication prices by up to 80%.

If there’s one trend that can’t be ignored right now, it’s the rapid rise of the personalized weight management market, a market reshaping health on a global scale.

What “Overweight” Really Means

Did you know that more than 43% of the world’s population is considered overweight? That’s how it looks if we put it in concrete numbers: 3,478,700,000. That’s 3.4 billion people. It means that, on average, 2 out of every 5 people are overweight.

They are not a small group on the fringe, but the majority. And yet, for decades, this group has been made to feel like the exception, being overlooked by mainstream social narratives and aesthetic norms.

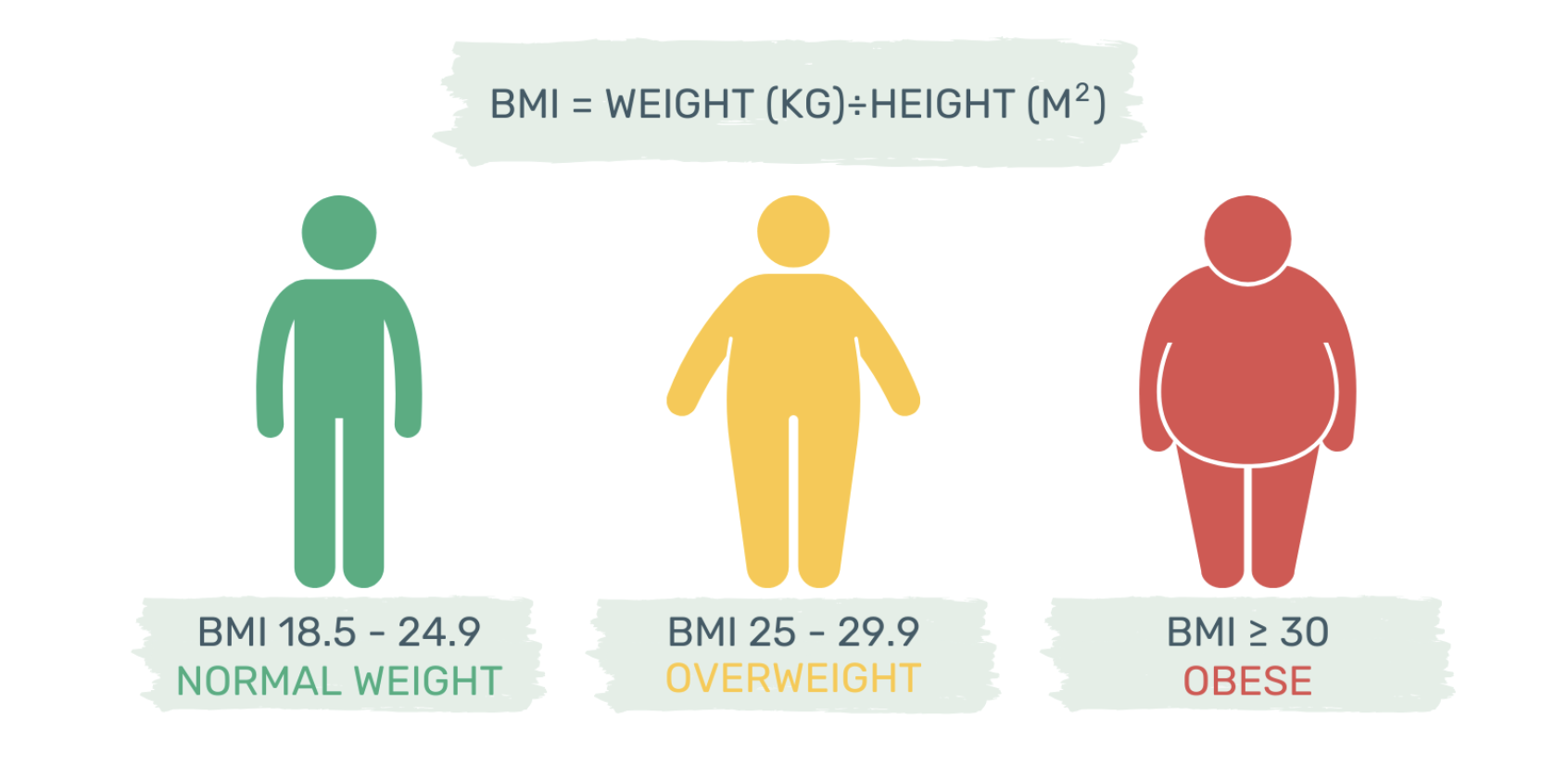

When we talk about being overweight, what do we really mean? In the current social media–fueled fitness craze, this question might seem outdated. So let’s take it out of vague terms and into science: the Body Mass Index (BMI). A global health standard, not some TikTok trend, defines overweight as a BMI of 25 or more. And if one’s BMI is greater than 30, then one is defined as obese.

*▲Obesity in adults, picture’s from PAN International Foundation, copyright belongs to original authors*

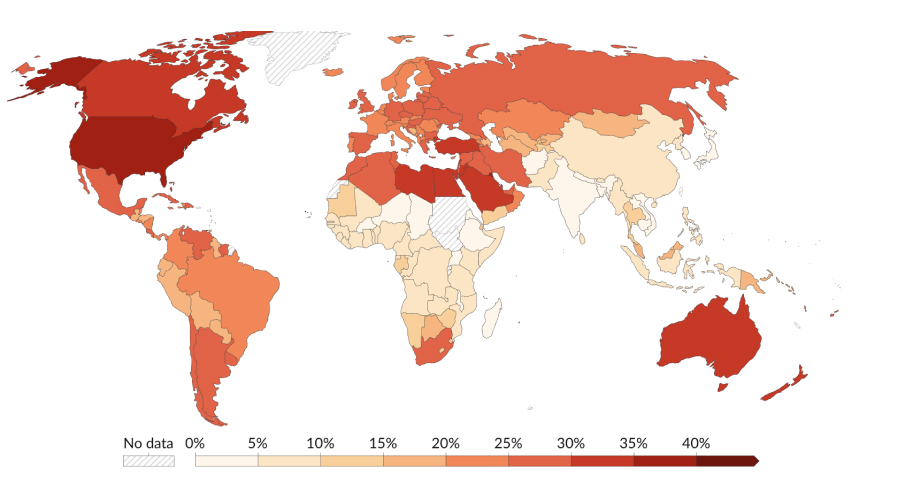

By this measure, Asian countries have relatively high healthy weight rates. In China, Japan, South Korea, Singapore, and India, only about 15% of the population is overweight or obese. But in some countries outside Asia, being overweight or obese is far more common.

Countries like the U.S., the U.K., and Australia are seeing over two-thirds of adults in the overweight or obese range. In the U.S. alone, 74% of adults fall into that category, with 42% considered obese (BMI ≥ 30). Across EU nations, the overweight/obese rate generally ranges between 53% and 60%.

*▲BMI (Body Mass Index), picture’s from Our World in Data, copyright belongs to original authors*

Even developing nations are catching up. In South America, overweight rates are also high: over 30% in Chile and Argentina, and about 25% in Bolivia, Ecuador, and Brazil.

These figures cover only adults. Overweight and obesity among children and adolescents are also growing concerns. In the U.S., 2 in 5 adults are obese, and 1 in 5 children is as well.

Globally, it’s estimated that over 3 billion people are overweight or obese (BMI ≥ 25), with over 1 billion falling into the obese category (BMI ≥ 30). This base is expected to exceed 50% within five years.

The Shift from Shame to Solutions

A large base doesn’t automatically mean a huge market, but a strong intent to act does. For a long time, the conversation around weight was filled with shame, stigma, and moral judgment. But something is changing. We’re seeing a shift.

In high-obesity regions, ongoing public health campaigns have raised awareness about the importance of maintaining a healthy weight. For instance, the U.S. officially classified obesity as a chronic disease in 2013.

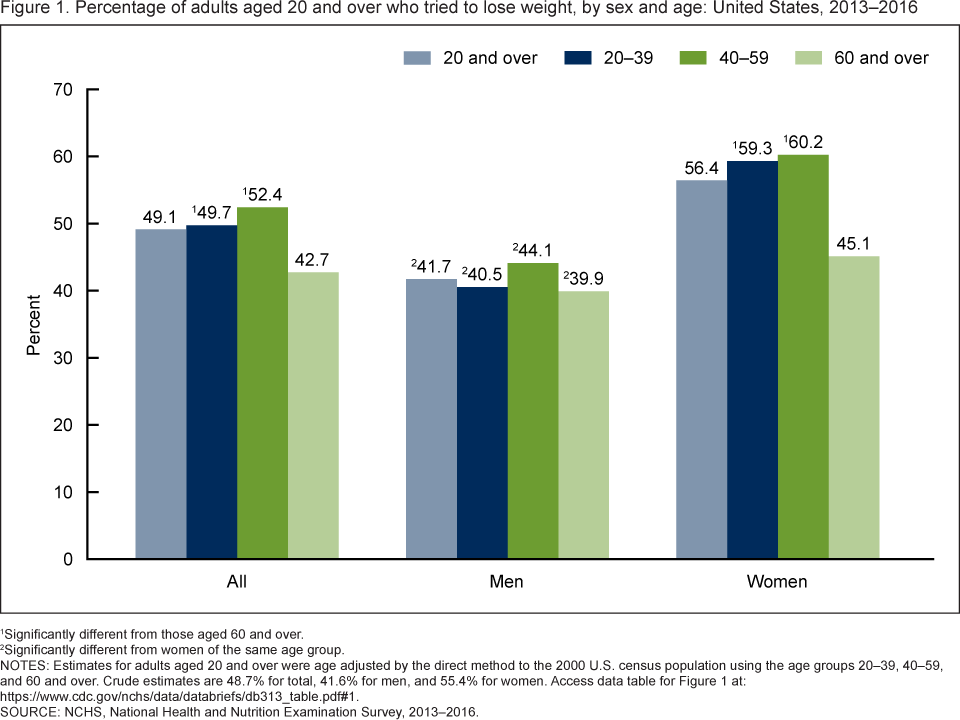

Global awareness of healthy weight management is emerging.

– In the U.S., over 50% of adults try to lose weight each year.

– In the U.K., that number is over 40%.

– More than half of Australian and Canadian adults express a desire to manage their weight.

*▲Distribution of People Trying to Lose Weight in the U.S. (By Age Group), copyright belongs to original authors*

But here’s the thing. Obesity is caused by complex factors, but the effective solutions still boil down to two: calorie control and increased exercise. And one-size-fits-all solutions don’t work. That’s where personalized weight management comes in.

Trump’s Policy Shake-Up: A New Era for Weight Loss Medication?

As public understanding develops, so does the market around it. Who are the most trendy companies in this space? Let’s start with pharma giants like Novo Nordisk and Eli Lilly, developing cutting-edge medications like GLP-1s that target appetite hormones and metabolism, helping patients reduce their appetite to eat more.

*▲Boxes of Wegovy made by Novo Nordisk, copyright belongs to original authors*

These drugs cost over $1,000/month, and yet demand has exploded. Analysts from Goldman Sachs to JPMorgan estimate the new weight-loss drug market could exceed $100 billion by 2030.

But a major shift may be on the horizon.

On May 12, 2025, President Donald Trump signed an executive order enacting a “most-favored-nation” pricing policy, aiming to slash U.S. prescription drug prices by up to 80%. If applied to obesity medications, this could drastically increase access for millions of Americans who previously couldn’t afford these treatments.

This pricing reform signals more than just cost reduction. It could be the breakthrough moment that transforms weight-loss drugs from premium solutions for the few into public health tools for the many. In doing so, it positions science-backed, personalized weight management as not just a trend, but a cornerstone of the future health economy.

What Personalization Really Looks Like

Beyond effectiveness, professionalism and personalization are the next major drivers of market trends.

Both Eli Lilly and Novo Nordisk are partnering with digital health platforms (like Ro, LifeMD, and Teladoc) by late 2024 to early 2025, combining medical treatment with fitness and behavioral guidance. The reason behind are also clear:

Medication only controls the desire to eat more, but it doesn’t fundamentally help with weight management.

*▲LifeMD Website, copyright belongs to original authors*

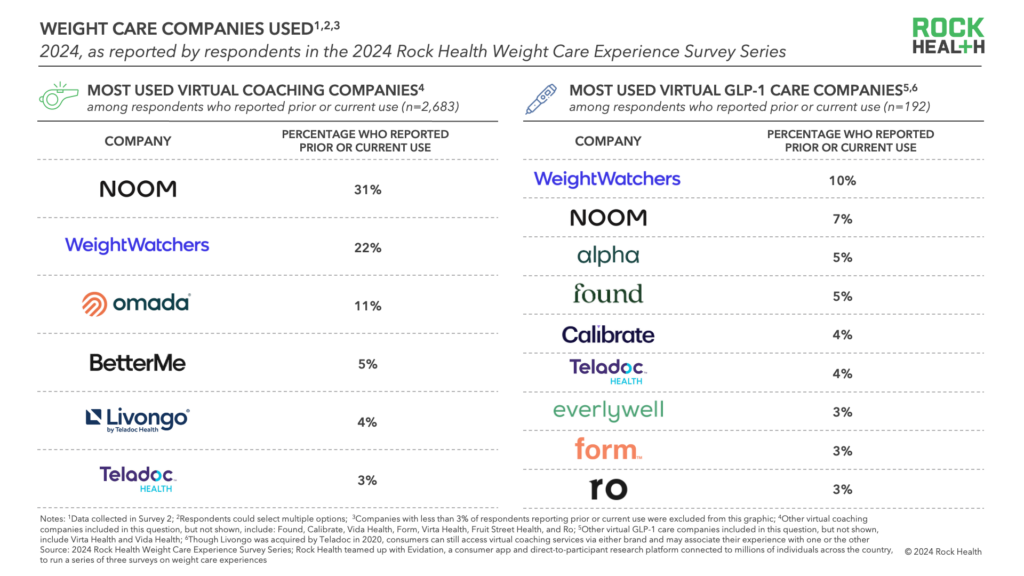

Even without backing from pharma billionaires, weight management is a core service for digital health platforms. Surveys show 81% of users who engage in online weight loss programs have already tried offline professional help. This has driven the rise of platforms like Noom and WeightWatchers. These platforms offer personalized coaching, weight control support, and adaptive nutrition plans.

*▲Weight Care Companies, copyright belongs to original authors*

Apart from coaching, there’s also significant demand for calorie and activity tracking tools.

According to a survey of 10,000 overweight Americans, nearly 1 in 3 had used such self-monitoring tools. Data from IQVIA suggests that professional apps targeting overweight individuals see average downloads of around 1.5 million globally. Dedicated platforms like MyFitnessPal are a good example, focusing on tracking calorie intake, exercise, and nutrition.

Apps like Noom and MyFitnessPal succeed because they excel in three key areas: personalization, convenience, and professionalism. This isn’t just about custom plans but about the details.

Take MyFitnessPal as an example. It lets users customize their dashboard to prioritize the nutritional data that matters most to them. That’s personalization in action. Behind this move lies professionalism: developers must understand that different obesity causes demand for different data. What seems like a minor UI tweak can significantly improve the app’s accessibility and engagement rate.

*▲MyFitnessPal App, copyright belongs to original authors*

As wearable tech becomes more diverse (like smart rings we’ve analyzed before) and biotech becomes more accessible, weight management is inevitably expanding into a more convenient, professional, and personalized field.

Comprehensive solutions for weight management have just emerged on the market. For example, ZOE, a smart nutrition management service, uses blood testing. Users begin by providing a blood sample and logging their food intake for one week. The app then analyzes metrics such as blood sugar, blood lipids, gut microbiota, and dietary structure to help users plan meals and nutrient intake, offering scientific and personalized support for their weight management goals.

*▲ZOE, copyright belongs to original authors*

Opportunities and the Hard Truths

Though technology and consciousness are emerging, the road ahead is still far from smooth. Weight loss isn’t just an ideal aim. It’s a long-term battle involving food assessment, eating habits, and lifestyle patterns.

On one hand, weight-loss medications can passively help with weight reduction by suppressing appetite, but their high cost and complex medical guidelines present substantial barriers. On the other hand, active weight loss strategies, such as controlling diet or maintaining regular exercise, challenge users’ physical and mental endurance.

Fix the Drop-off Rate of Apps

Take calorie-tracking apps as an example, while having high download numbers, they also suffer from high dropout rates. Why? Because logging meals and tracking macros doesn’t change our mindset.

Studies show that individuals who use mobile apps for weight loss generally maintain results for only 3 to 12 months, and the actual weight loss tends to be minimal in proportion to their overall body weight. So relying solely on apps for active weight loss rarely produces significant or sustainable results.

However, when human coaching is added to the equation, success rates improve dramatically. Other studies indicate that when mobile apps are combined with real human intervention (e.g., a real-person coach), the effectiveness of weight loss improves. If a product can integrate professional consultation or medical guidance with monitoring-based apps, it may have the potential to address key market pain points and truly help a broader population achieve their weight loss goals.

*▲Personal coach, picture’s from BBC News, copyright belongs to original authors*

Increase Product’s Accessibility

From a global perspective, whether it’s weight-loss drugs, monitoring devices, or professional consultations, accessibility remains a critical issue. Aside from cost, surprisingly, age remains as a major barrier for users.

apps for calorie or glucose monitoring face difficulties when serving their intended primary audience: older adults, who may struggle to navigate app interfaces, preventing them from achieving their health and weight management goals.

Similarly, as we’ve discussed before, wearable tracking products or services like smartwatches or other health trackers, often present significant usability challenges for the elderly.

A Missing Gap: Mental Health Support

Another major gap in the personalized weight loss market is mental health support.

Obesity is not just a physical issue. Overweight and obese individuals are more likely to suffer from mental health issues like depression, anxiety, and emotional disorders, with depression rates increasing by as much as 58%.

Achieving proactive weight management not only requires helping individuals accept lifestyle changes, but also supporting them psychologically through the process, helping them stay committed and achieve sustainable, long-term success. If we ignore that, we’re building beautiful tools for the wrong battlefield.

Simply put, we can’t just tell people to get up and lose weight when they’re fighting not just cravings, but mental fatigue, self-doubt, and stigma. True weight management is psychological. But currently, these supports are still largely missing in our field.

Where We Go From Here

From “being overweight” to “scientific weight loss,” the global market is undergoing a profound transformation. More than half the global population is now overweight. This is not a niche concern. This is the largest public health challenge of our time—and a massive and continuously expanding market.

The great thing is, people are realizing that weight loss shouldn’t be about blind dieting and anxiety, but a scientific, long-term, and individualized journey toward health. So no matter if you’re a startup founder in digital health, a leader in biotech, or an individual trying to take control of your own health, we are all part of this shift.

If we get it right, weight management won’t just be another industry. It will be a new frontier in human-centered health.