By any conventional measure, Labubu should not have become a global hit. The wide-eyed, snaggle-toothed plush figure looks more like a misfit than a mass-market star, especially when compared to competitors like Mattel, Funko, or even Lego.

Yet over the past two years, this unlikely character from Hong Kong artist Kasing Lung has propelled POP MART, the Beijing-based toy company, into the spotlight of Western consumer markets. Stores in London, New York, Berlin, and Los Angeles now draw queues more reminiscent of sneaker drops than traditional toy retail. Labubu’s immense popularity has sparked the rise of counterfeit plushes, such as Lafufu, now hitting the market.

The Breakthrough In the Global Market

*▲Black Pink Members & Labubu, Source: Rose & Lisa’s Social Media*

POP MART’s expansion beyond China coincided with a global appetite for “kidult” collectibles, adult consumers buying toys as lifestyle markers. In Europe and North America, Labubu has been at the forefront. Oxford Street in London, a Berlin flagship, and a Glendale Galleria shop in California have become destinations not just for shoppers, but for content creators documenting lines, hauls, and trades.

The phenomenon crossed into mainstream fashion and culture after BLACKPINK’s Lisa posted photos with Labubu in 2024. Almost overnight, the plush toy evolved from niche collectible to accessory of choice, dangling from tote bags and appearing in outfit-of-the-day posts. It has been spotted on Rihanna, Kim Kardashian, Dua Lipa, Lizzo, Hailey Bieber, and even David Beckham and Madonna.

But Labubu’s virality is not solely due to celebrity influence. While Lisa’s post gave it initial momentum, the broader public ultimately drove the viral explosion.

Social Media as a Labubu’s Fame Growth Engine

Labubu’s rise is inseparable from its online presence. Unlike legacy toy giants—Mattel, Hasbro, or Funko—POP MART treats social media not as an accessory to marketing, but as the stage itself.

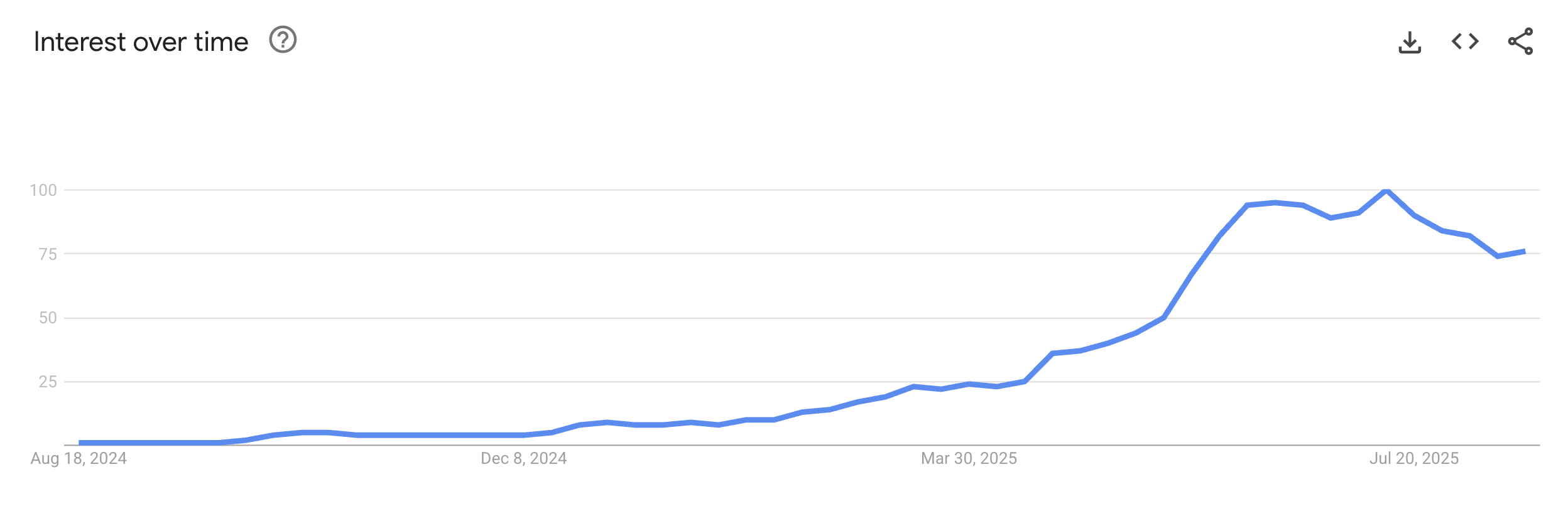

Looking at POP MART’s growth curve in Europe and the U.S., it’s clear that Labubu’s real inflection point didn’t happen immediately after Lisa’s viral post in November 2024. Google Trends data shows that the true search surge came three months later, around March 2025.

Between January and March 2025, TikTok saw more than 1.4 million posts tagged with #Labubu. But the craze truly exploded between March 1 and May 29: video views hit 1.1 billion, an additional 68,000 #Labubu videos were uploaded, and order volumes skyrocketed by 819%.

*▲Soaring Searching Trend of Labubu, Source: Google Trend*

On TikTok, unboxings became entertainment, and user styling transformed Labubu into a fashion prop, crossing from niche collector culture into lifestyle feeds. Celebrity signals amplified the loop, pushing the brand into global timelines at a fraction of conventional ad costs. Labubu became more than a toy—it became a form of social currency.

Overnight store lines are filmed, shared, and recycled into FOMO-laden clips. In Q1 2025, POP MART’s financial report itself became news content, sparking coverage across business outlets. Even more striking: U.S. revenue for Q1 2025 exceeded POP MART’s entire American sales for all of 2024.

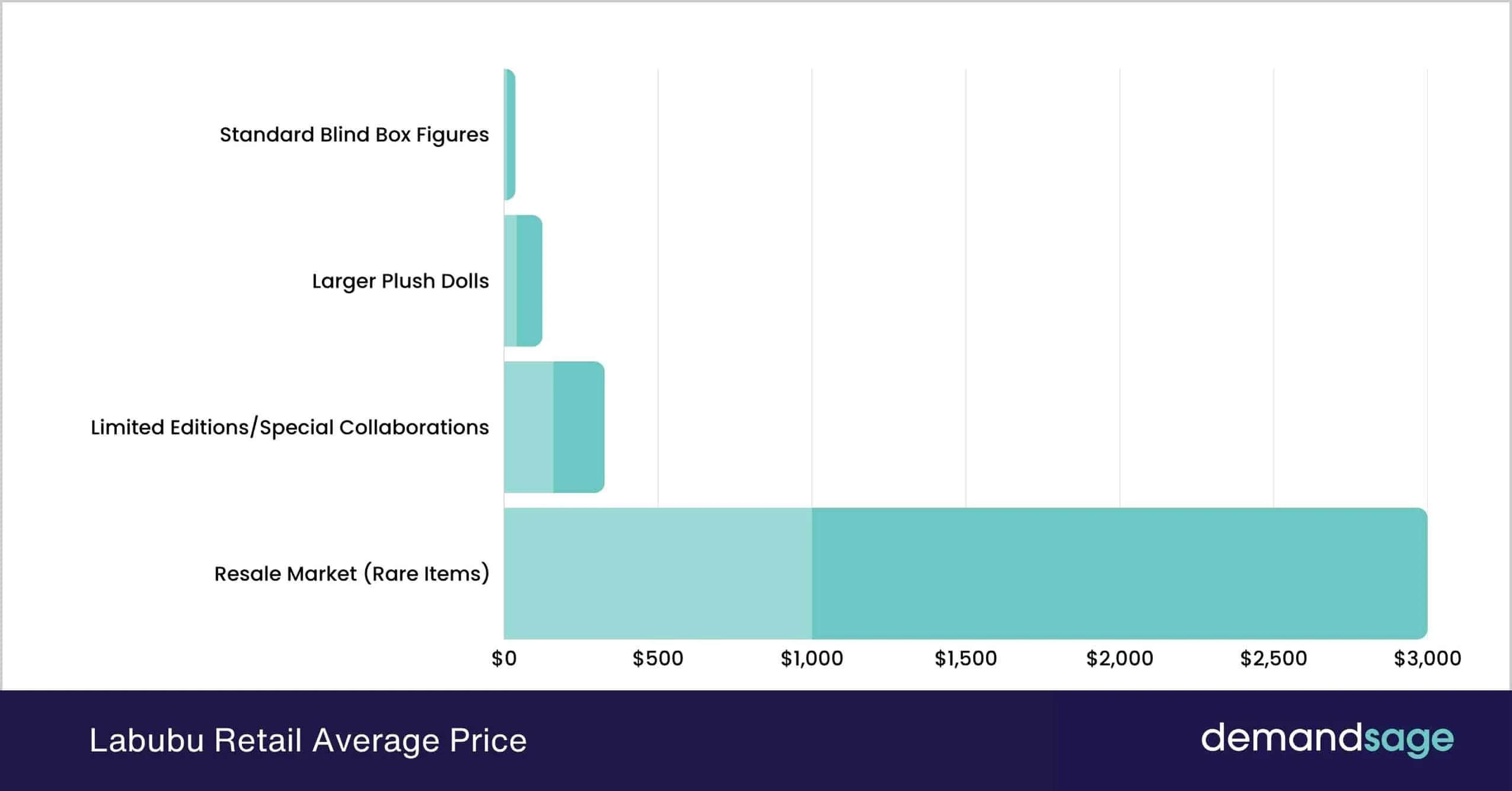

Then came the second-hand boom. Limited-edition Labubus, retailing for under $20, began commanding hundreds or even thousands of dollars on resale platforms like StockX and eBay. This secondary market validated scarcity as part of POP MART’s design, creating a feedback loop: resale headlines drew casual observers, who turned into first-time buyers chasing the next drop.

*▲Labubu’s second-hand boom, source: DemandSage*

The Psychology Behind POP MART’s Blind Box Collectibles

*▲Labubu Blind Box On Social, Source: 8days*

At the core of POP MART’s strategy lies the “blind box” model: most boxes contain standard figures, while a small fraction hide rare or “secret” editions. This sales mechanism mirrors what behavioral economics calls “variable-ratio reinforcement”—the same principle that makes slot machines addictive. According to The Wall Street Journal, more than 70% of POP MART’s revenue in 2019 came from blind boxes. Other market studies show that this segment has been growing at roughly 25% annually, reaching 82% of total revenue by 2023.

This “engineered uncertainty” keeps consumers coming back. The “one more try” mindset amplifies collecting urges. Professor David Bosch notes that “Blind boxed for many consumers is an experience, not a product. You’ve invested that anticipation and you want that big payoff.”, and this mechanism “resembles very strongly gambling”. The psychological pull has even prompted regulatory scrutiny in parts of Asia. For instance, since 2023, China has banned the sale of blind boxes to children under eight.

In the U.S., however, the trend looks different. The main buyers are “kidults”—Millennials and Gen Z aged roughly 18–35—along with young fashion and accessory enthusiasts. In the quest to complete a full set or to get the rare edition, consumer desire is fully activated. They spend more time unboxing, posting videos, and paying hefty sums for it. Some collectors have even spent thousands of dollars just to complete a full set.

Pop Mart’s King Weapon: Artists’ IP

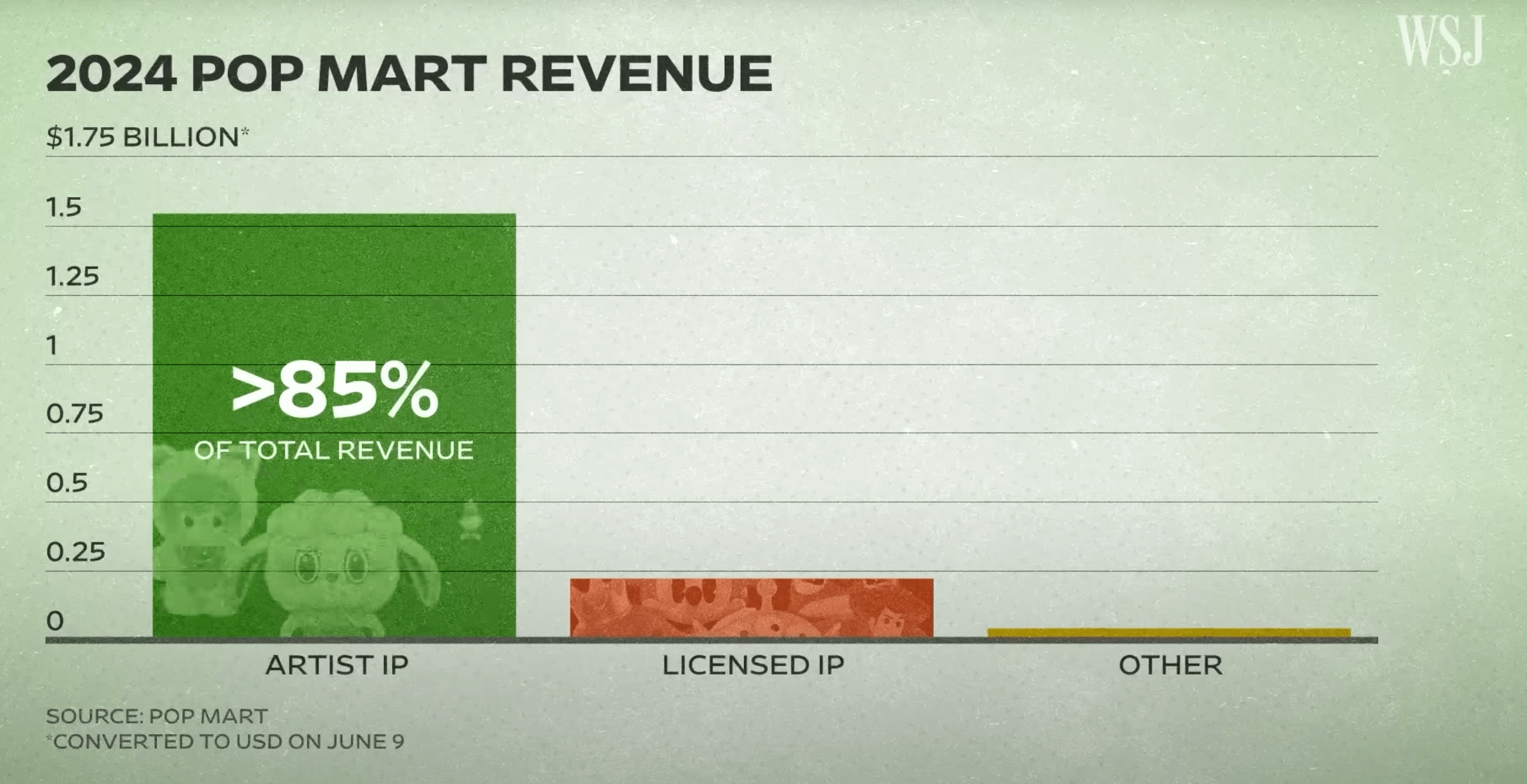

*▲Pop Mart’s Artist IPs Sales Revenue, Source: Wall Street Journal*

Labubu’s rise is more than just the tale of a quirky toy going viral — it signals a deeper shift in consumer marketing. Today’s buyers value scarcity, social loops, and self-expression over mere product function. Labubu became a lifestyle symbol not only because it was engineered as addictive social currency for online virality, but also because it leaned on distinctive artist IP rather than traditional franchise IP.

Traditional toy companies still rely on licensing deals tied to blockbuster films or predictable seasonal rollouts. Funko Pop’s success, for example, once hinged on recognizable characters from Marvel and Disney. POP MART thrives on artist-driven IP, containing over 85% of Pop Mart’s total revenue.

In recent years, collaborations between brands and artists’ IP have emerged as a powerful marketing engine. Collections like Nike x Takashi Murakami, Uniqlo x KAWS, and Beats by Dre x Futura follow the same playbook. This trend thrives at the intersection of culture, exclusivity, and storytelling. By collaborating with artists, illustrators, or digital creators, brands tap into existing fan communities, creating a built-in audience hungry for limited-edition drops, eventually driving sales growth and share price increases.

A Lesson Labubu Offers Global Brands

Labubu hasn’t just filled wardrobes and display shelves — it has captured people’s attention everywhere. For global brands, Pop Mart delivers a crucial lesson: product sales ultimately hinge on originality, the ability to command social media attention, and earning user loyalty.

Its success shows that the future of consumer goods will rely less on traditional categories and more on whether a brand can spark cultural and social resonance. Products that foster community and shared experiences are no longer optional — they’re becoming essential. The real winners will be brands that understand psychology, cultural trends, and the digital ecosystem.